The Dynamics of Crisis, a Decade Out

Ten years ago, investors stood on the threshold of one of the most traumatic market environments of modern times. From the end of August 2008, through March 9, 2009, the Standard & Poor’s 500 Index declined by 47%. An erosion of confidence in U.S. mortgage-backed securities became a full-blown global financial crisis revealing an unsettling fragility across debt markets, money market funds, major money center banks and brokerage firms.

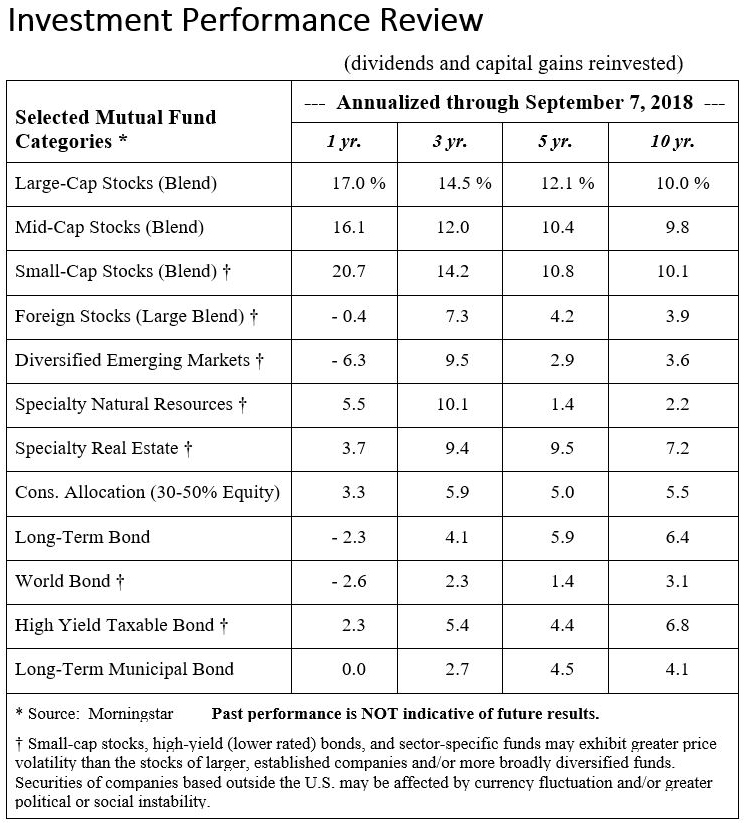

That lookback prompts two salient observations. First, events can turn markets in dramatic ways with little warning. Second, selling out ten years ago would have looked real smart for a while, but only if one had the intestinal fortitude to re-enter the market relatively early in the subsequent recovery, while the memory of financial crisis and market panic was still fresh. After all, the ten-year numbers in the accompanying table include that sickening six-month sell-off noted above. As is often the case, the early stages of recovery were most dynamic. The S&P 500 rallied 66% from that March low to the end of 2009. That big bounce turned out to have remarkable legs, eventually becoming the longest-running bull market in U.S. history at more than 3,550 days and counting.

For most of that period, and certainly in terms of overall performance, U.S. listed stocks have commanded the spotlight. A broad blend of foreign equities has lagged badly, barely managing to beat the 10-year results for a globally diversified bond portfolio. Meanwhile, this year’s strength in the dollar and a laundry list of country-specific crises have contributed to a deeper swoon for Emerging Market (EM) stocks. That recurring scenario has challenged the long-touted premise that dynamic EM growth will eventually translate into a level of multi-year market returns that would justify the risk.

Exactly when these trends might shift is anyone’s guess. We do know that it can pay to redeploy a few dollars from one’s winners into the relative laggards. But that is not always a risk-reducing strategy.

Dean Eisenbraun, Financial Advisor

Lion Financial Advisors

Securities and advisory services offered, in states where licensed, exclusively through representatives of KMS Financial Services, Inc.,

Member FINRA/SIPC and an SEC Registered Investment Advisor.

This site is for information purposes only and is not an offer to sell or a solicitation to buy any securities or investment advisory services which may be referenced herein. We may only offer services in states in which we have been properly registered or are exempt from registration. Therefore some of the services mentioned may not be available in your state, and if not, the information is not intended for you.

Investments Are: NOT NCUA/FDIC INSURED, NO CREDIT UNION GUARANTEE, MAY LOSE VALUE.